Signet's Settlement System

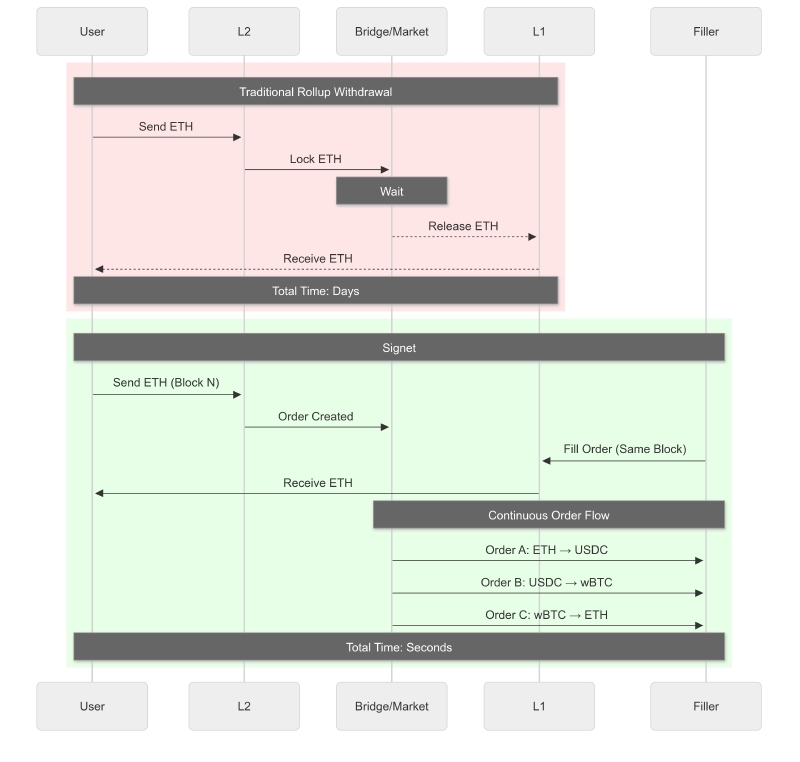

Traditional rollups lock capital and introduce:

- Multi-step withdrawal processes: Initiate → Wait → Release

- Multi-day fraud proof windows: Capital remains locked and unproductive

This design creates a poor experience for users, builders, and solvers.

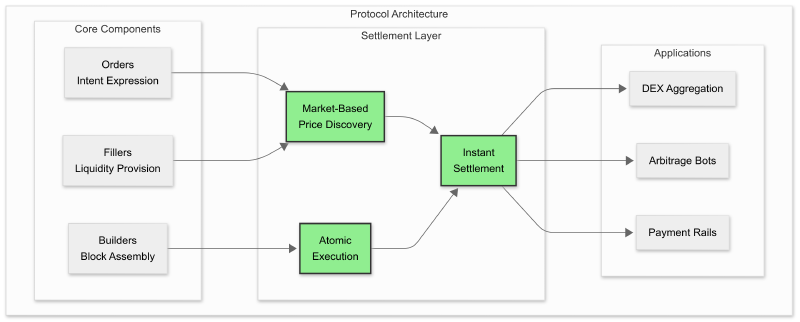

Market-Based Settlement

Signet eliminates the complicated withdrawal process and unnecessary delays through swaps by:

1. Synchronized Block Production

- Identical timestamps ensure deterministic ordering

- Fork-choice rule maintains consensus alignment

2. Atomic Cross-Chain Execution

- Same-block finality

- Conditional transaction enforcement

3. Market-Driven Price Discovery

- Competitive filler ecosystem

- Real-time liquidity provision

Signet is the only chain to achieve same-block cross chain settlement and it starts with our synchronized block architecture.

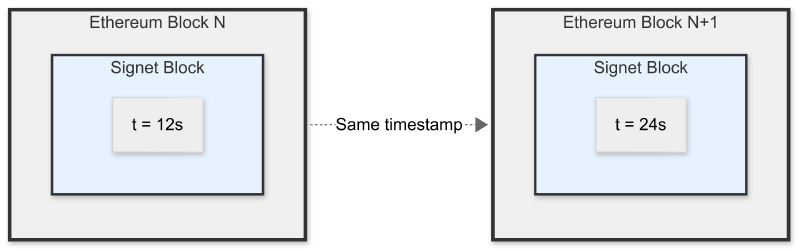

Concurrent Block Production

This 1:1 coupling enables deterministic state transitions. Every Signet block corresponds to exactly one Ethereum block, eliminating timing discrepancies.

Order System Architecture

Orders express atomic intent through Permit2, enabling gasless authorization:

1pub struct SignedOrder {

2 pub permit: Permit2Batch, // Single signature authorization

3 pub outputs: Vec<Output>, // Desired assets and destinations

4}

5

6pub struct Output {

7 pub token: Address, // Asset identifier

8 pub amount: Uint<256, 4>, // Precise amount

9 pub recipient: Address, // Destination address

10 pub chainId: u32, // Target chain

11}

Order Lifecycle:

- Creation: User signs intent with ~10 minute validity window

- Discovery: Broadcast to transaction cache for filler evaluation

- Execution: Atomic settlement within single block

- Finalization: Immediate availability on destination chain

Settlement Mechanics: Inverted Execution

Signet’s approach to atomicity is in transaction ordering enforcement:

The OrderDetector enforces atomicity by validating that every order has corresponding fills before allowing transaction execution. This prevents partial settlements through deterministic state validation:

1impl OrderDetector {

2 fn validate_transaction(&self, tx: &Transaction) -> Result<(), Error> {

3 // Check if transaction emits Order event

4 if let Some(order) = self.detect_order(tx) {

5 // Verify all outputs have corresponding fills

6 for output in order.outputs {

7 if !self.has_sufficient_fill(output) {

8 return Err(Error::InsufficientFill);

9 }

10 }

11 // Consume fill amounts to prevent double-spending

12 self.consume_fills(order.outputs);

13 }

14 Ok(())

15 }

16}

Key Benefits:

- Fill transactions must mine before Initiate transactions

- Failed fills result in automatic Initiate rejection

- No intermediate states or partial executions

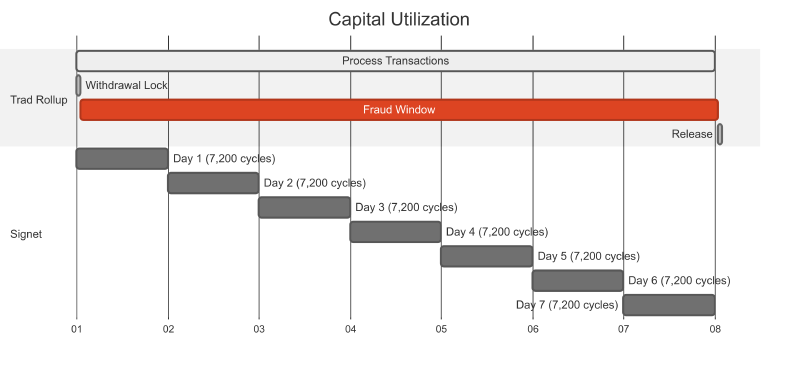

Capital Efficiency

Traditional rollups lock capital for extended periods. Signet enables continuous deployment:

Note: While traditional rollups process transactions continuously, settlement requires days. Signet settles every transaction in seconds.

This enables strategies previously impossible on other chains:

1. Intra-Block Arbitrage

- Execute multiple trades within single 12-second block

- Compound returns through circular trading paths

- Eliminate sequential execution risk

2. Dynamic Inventory Management

- Real-time cross-chain balance optimization

- Just-in-time liquidity provision

- Zero idle capital

3. Multi-Order Aggregation

- Net positions across multiple orders

- Reduce transaction costs through batching

- Maximize capital efficiency per block

Bundle Construction

Fillers aggregate multiple orders into atomic execution bundles:

1async fn construct_bundle(&self, orders: &[SignedOrder]) -> Result<SignetEthBundle> {

2 // Aggregate orders by destination chain

3 let aggregated = self.aggregate_by_chain(orders);

4

5 // Sign fills for each destination

6 let signed_fills = self.sign_fills(&aggregated).await?;

7

8 // Build transaction sequence with proper ordering

9 let txs = self.sequence_transactions(&signed_fills, orders).await?;

10

11 // Extract cross-chain coordination data

12 let host_fills = signed_fills.get(ÐEREUM_CHAIN_ID);

13

14 // Atomic bundle with deterministic execution

15 Ok(SignetEthBundle {

16 host_fills, // Ethereum-side actions

17 bundle: EthSendBundle {

18 txs, // Signet-side transactions

19 block_number: self.target_block(),

20 reverting_tx_hashes: vec![], // No reverts allowed

21 },

22 })

23}

Error Handling:

- Invalid signatures → Bundle rejected pre-execution

- Insufficient liquidity → Fill transaction reverts

- Gas exhaustion → Entire bundle fails atomically

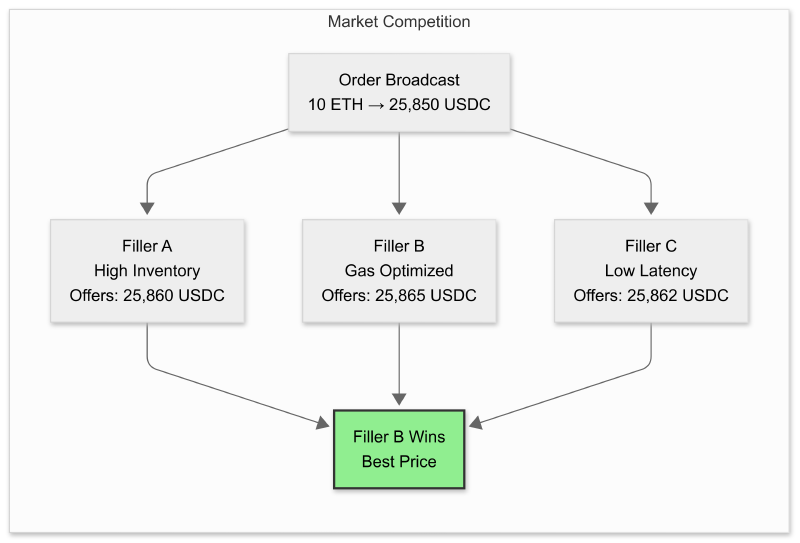

Market Efficiencies:

Multiple fillers evaluate each order simultaneously, creating competitive pricing:

- Multiple fillers evaluate each order simultaneously

- Competition drives spreads toward equilibrium

- Price discovery occurs every 12 seconds

- No single filler controls market pricing

- Capital availability across chains

Filler Infrastructure

Implement custom market-making strategies using the Signet SDK:

1// Custom filler implementation

2impl FillerStrategy for MyFiller {

3 async fn evaluate_order(&self, order: &SignedOrder) -> Option<FillDecision> {

4 // Implement custom pricing logic

5 let profit_margin = self.calculate_margin(order)?;

6

7 // Check inventory across chains

8 let has_liquidity = self.check_inventory(order).await?;

9

10 // Evaluate competition

11 let competitive = self.estimate_win_probability(order);

12

13 if profit_margin > self.min_margin && has_liquidity && competitive > 0.3 {

14 Some(FillDecision::Accept)

15 } else {

16 None

17 }

18 }

19}

- Gas cost optimization

- Inventory rebalancing costs

- Competition assessment

- Risk-adjusted profit margins

Protocol-Level Markets

Signet’s architecture embeds market mechanics at the protocol level:

Every application built on Signet is enabled with instant cross-chain settlement.

Cross-Chain Settlement Opportunities

Whether it’s building user applications, providing liquidity, or executing orders, every builder benefits from the speed of settlement to Ethereum:

- No asynchronous state risks between chain operations

- No wrapped token complexity or liquidity fragmentation

- No artificial constraints on capital deployment

- No settlement uncertainty affecting execution

Build with us

The best way to get started is with our docs or getting in touch if you have any questions.

Get Involved:

Market Participants:

- Filler examples: Complete implementation patterns

- Market dynamics: Participant roles and incentives

Order System:

- Contract interfaces: Permit2-based order creation

- SDK primitives: Type-safe order handling

Bundle Construction:

- Atomic execution: Transaction sequencing tools

- Simulation framework: Pre-execution validation