Rollups are supposed to be a bet on Ethereum, not on isolated ecosystems, new governance tokens, or new trust assumptions. The bet is that Ethereum scales by extending its execution environment. All the tools you know. All the liquidity. All the finality guarantees. Just more room.

That’s not what’s happening.

The OP Stack, the most widely forked rollup framework, has inspired over a dozen one-click vampire attacks with optional fault proof systems. Users are isolated. Developers are fragmented. Time, attention, and capital drift from L1 into the silos of these Optimism and Arbitrum clones. Maybe two or three are worth mentioning, but for what? We’ve strayed too far from first principles.

Signet brings it back, one block at a time. The rollup as intended: an extension of Ethereum.

Proving vs. Executing

If rollups aren’t rushing to real fault proofs, and the economics don’t clearly reward reaching Stage 2, then “optimistic” stops meaning secure, credibly neutral execution with enforced correctness. It starts meaning, in the optimistic case, a fast chain you hope is operated by the right set of signers.

What application developers actually need is orthogonal to the fraud proof debate: fast, reliable withdrawals. Predictable settlement. Clear guarantees about what is and isn’t final. Same-block cross-chain actions, not 7-day challenge windows.

Those are execution and settlement problems.

Events vs. Assumptions

With traditional rollups, correctness depends on honest fault proof submission and an ecosystem that actually runs the infrastructure to challenge bad states. The system assumes execution is correct unless someone expensively proves otherwise.

Signet inverts this. Correctness is validated during execution, not after. Events are the primitive: the system is built around this event happened, therefore these transitions are valid, not someone might eventually prove this was wrong.

You cannot validate a rollup without also validating its host chain. Instead of fighting this dependency, we embraced it.

An Order on Signet is only applied to rollup state if every corresponding Fill event exists on-chain. The execution engine checks this during block production, not in a challenge window days later.

After years of deferred fault proofs, we’re betting that correctness enforced during execution beats correctness verified after the fact. The challenge window is zero, because the validation happens in the block.

Extensions work better than replacements.

Cross-Chain Settlement

The OP Stack promised a “Superchain”: interconnected chains that talk to each other. In practice, we got rollup-to-rollup bridges without native interoperability to Ethereum L1, or clean semantics for cross-chain applications that need hard guarantees. The path that had to work from day one, rollup to Ethereum, was deprioritized in favor of intra-ecosystem interop.

Signet enshrines cross-chain transfers at the protocol-level. A user signs an Order specifying inputs and outputs across chains. Fillers fill both legs. Builders include them in the same Ethereum block. Both sides execute or neither does. No bridge contracts. No escrow. No partial fills. A filler’s incentive to fill is completely economic end-to-end, never subsidized by unsustainable token emissions. Our early evidence will show how attractive this is. We’ll be actively working with applications, developers, and fillers to understand where we can push things and iterate in real-time on the interface designs.

Block Production and Economics

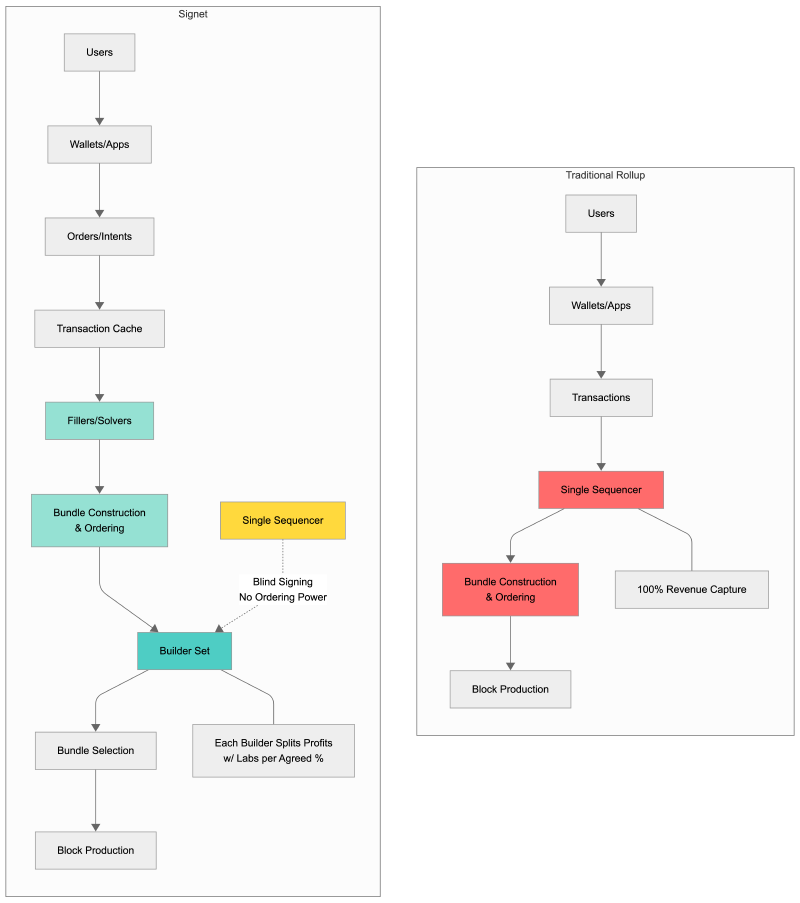

Traditional rollups operate a centralized sequencer and a token. That token sits at the center of governance and — theoretically — value capture and security. Signet uses round-robin builder rotation with blind sequencer signing instead. Builders get predictable 8-second slots. The sequencer validates transaction structure without seeing contents; it cannot censor what it doesn’t know.

There is no Signet token. Revenue flows directly to builders and fillers. Every participant earns from economic activity from day one. Builders capture fees. Fillers capture MEV.

Traditional rollups concentrate value capture in the sequencer — 100% of ordering power, 100% of revenue. Nothing for their participants. Signet redesigned this approach from the bottom up to include our partners and applications inherit a lot of first class ordering rights to prevent any toxic value leakage.

No Signet token means no pseudo-governance gated decision making and no staking-based security — trade-in we accept because we think rollup economics should be wired to operating business logic, not propped up by inflated token emissions. There is no alternative agenda. We’re init4 the tech.

If any of this is the kind of rollup your application needs — get in touch and tell us what you’re building.